|

Despite a major push for broad infrastructure funding in the U.S. House of Representatives, recent

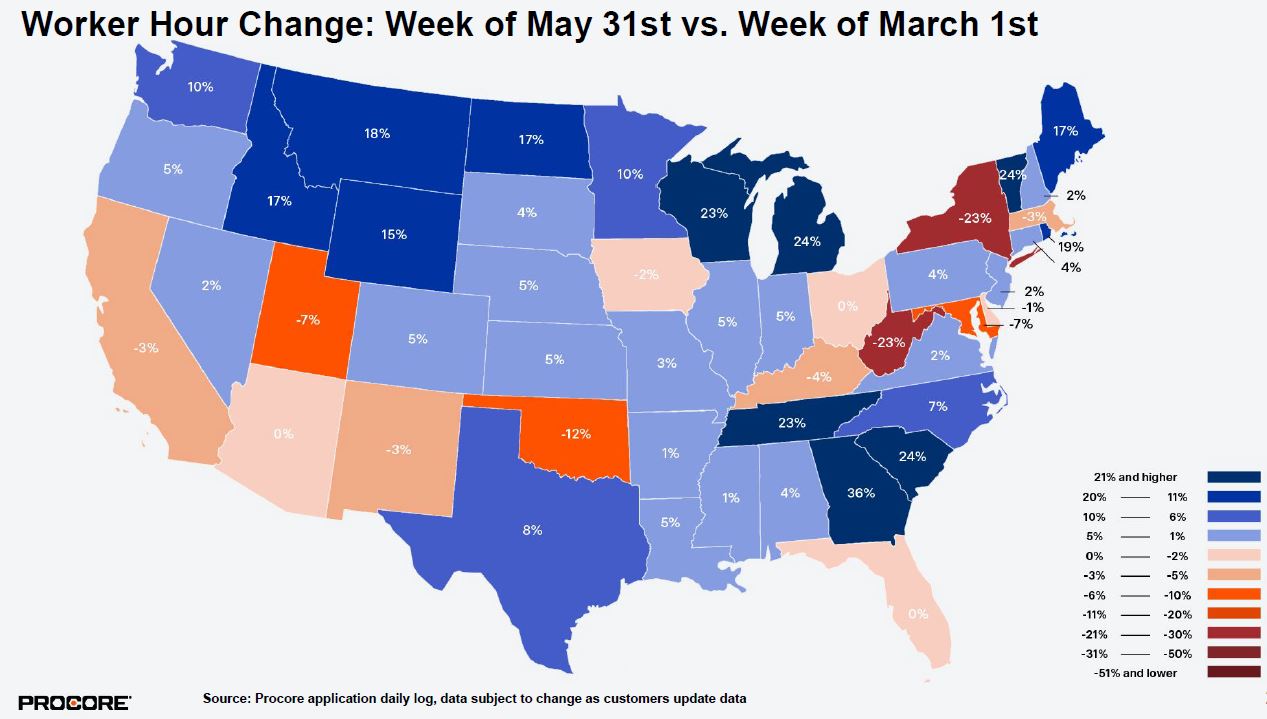

disruptions to the U.S. economy will extend the current recession possibly into 2021. Fallout from COVID-19, financial and equity market volatility, Federal Reserve emergency policies, and lower oil prices are contributing to the uncertainty, FMI reports in its second-quarter Outlook. “Based on the speed, breadth, and apparent lasting impacts of these various factors,” FMI is anticipating the current recession to continue through the remainder of 2020 and possibly into 2021, according to the report. Other factors include the uncertainty of the 2020 presidential election and social unrest. “Depth and reach of these disruptions will remain under close watch,” stated the consulting firm. Amid the uncertainty, the U.S. House of Representatives passed the $1.5 trillion Moving Forward Act, an infrastructure bill that would earmark funds for surface transportation, airport, school, housing, healthcare, energy, water, and broadband coverage. “However it also includes numerous anti-merit shop provisions opposed by Associated Builders and Contractors,” reports the organization. “By requiring anti-competitive provisions, such as government-mandated project labor agreements and inflationary Davis-Bacon prevailing wage requirements, this bill will dissuade contractors from bidding on projects, drive up overall costs and exclude the overwhelming majority of America’s construction industry professionals who choose not to join a union,” maintains the ABC. These measures would also have a devastating impact on small construction businesses that are seeking to recover from the ongoing health and economic crisis caused by COVID-19, ABC believes: “The path forward on repairing our nation’s infrastructure should be rooted in fair and open competition and equal opportunity, not policies that favor big labor and costly, ineffective federal mandates.” Other issues cloud the construction industry’s economic outlook. Nonresidential construction spending declined 0.9 percent in May, based on U.S. Census Bureau data analyzed by ABC. On a seasonally adjusted annualized basis, spending totaled $812.5 billion for the month, according to ABC. Private nonresidential spending declined 2.4 percent in May and public nonresidential construction spending increased 1.2 percent. However, the Associated General Contractors reports that construction activity returned to pre- coronavirus levels in 34 states, based on data on workers’ hours analyzed by Procore. An association survey found that only 8 percent of construction firms were forced to furlough or lay off workers in June while 21 percent report adding employees, compared to one-in-four firms letting workers go between March and May. “But it is important to remember that construction activity typically increases quite a bit between March 1 and the end of May as the weather improves and more work gets underway,” Ken Simonson, AGC chief economist, commented. “Getting to March 1 levels is a sign of progress, but it doesn’t mean things are back to normal.” Simonson added that the data show the severe toll the pandemic took on the construction industry. For example, 61 percent of firms report having had at least one project halted or canceled because of the pandemic. One in four firms report that construction materials shortages, caused by lock downs and trade disruptions, are causing delays on current projects. Meanwhile, the Procore data found that smaller firms experienced more severe declines in construction activity during the pandemic than larger firms. Resources AGC Chief Economist Ken Simonson AGC Survey June 18 Procore Construction Activity Index ABC Chief Economist Anirban Basu FMI Construction Forecast Comments are closed.

|

RSS Feed

RSS Feed